If your first letter does not receive a response within two weeks, you should then send your second debt collection letter. Debt Collection Letter 2: Sent 14 Days After Letter 1 You will see that the template has space for you to include the specific information about the invoice, as outlined in the section above. Like your email or call, this letter should be friendly and helpful and assume that the invoice has simply been overlooked.

If your phone call or email about a past-due invoice does not receive a response, or if you do not receive payment within 14 days of having spoken to your client, you should then send your first debt collection letter. Collection Letter 1: Sent 14 Days After Your Initial Reminder Call or Email

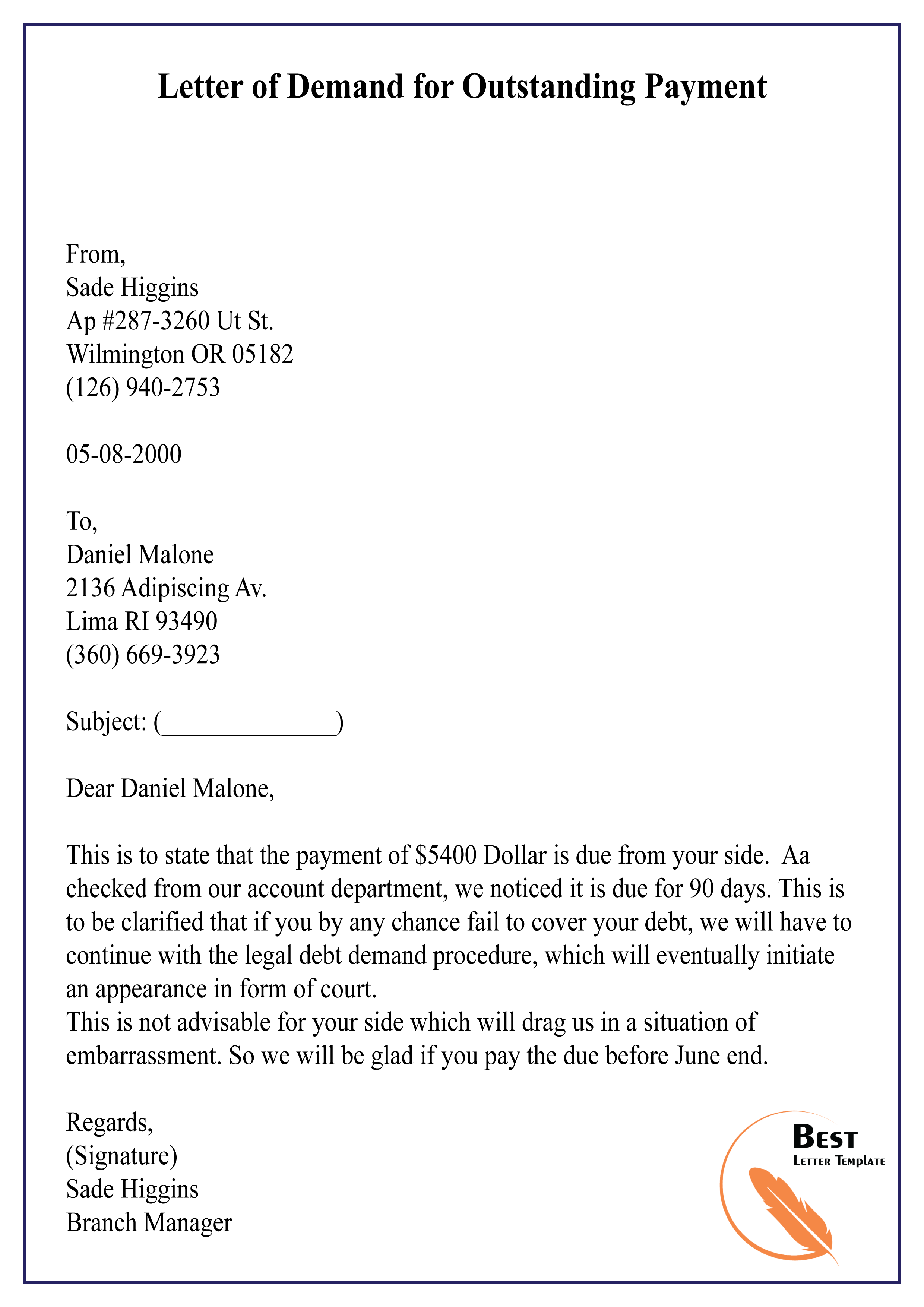

This proof will be important if you have to take legal action to collect. This will allow you to prove your letters were received. For all debt collection letters, it is important that you send them via certified mail with return receipt. You will find the library of templates meets needs for letters you should send for each stage of past-due status. Our debt collection letter templates can be easily downloaded and customized for your use. Letterhead: Write the letter on your company letterhead and be sure all contact information is evident.įor help with debt collection letters, explore our library of debt collection letter examples.Paragraph 3: In one sentence, thank the recipient for swift payment or a call to discuss terms.Paragraph 2: In bullet points, summarize the details of the past-due invoice, including invoice tracking number, the principal amount, any interest or fees and a description of what the original balance is for-including dates and locations.Paragraph 1: In one sentence, explain that you are writing about a past-due invoice.While follow-up letters to a debtor requesting payment will gradually be firmer in tone, each should contain the following information. With those goals in mind, any payment collection letter you send should be respectful, concise and specific. You want your debt collection letters to accomplish two goals: get payment and maintain good customer relations. How Do You Write an Effective Debt Collection Letter? Read further for debt collection letter samples you can use. If a phone call or email does not receive a response, it will be time to use an established library of debt collection letter templates that you can easily customize and mail. Use a friendly and helpful tone and ask to be sure the customer has received the invoice. In that phone call or email, give your customer the benefit of the doubt. To make this process easier, make sure you have a specific invoice reminder plan in place, which would begin with a phone call or email once the invoice is 14 days past due. Then, if you have a true past-due invoice, it’s time to reach out to your client.Įxperts agree that communicating about past-due invoices should happen early in the process (just 14 days past the payment due date). First, before you contact a client about a past-due invoice, check your records to be sure you haven’t made a mistake or received payment. When a non-payment happens, correctly communicating with clients about their past-due invoices is imperative.īecause you want to receive payment and dummy maintain a positive business relationship with your clients, your communications about past-due invoices must be handled professionally and with care. But because dummy receivables management is key to your business’s cash flow, avoiding non-payment from customers is critical. It’s not unusual for a client to fall behind on an invoice from time to time.

0 kommentar(er)

0 kommentar(er)